The Minister for Finance, Michael Noonan revealed this morning that Goldman Sachs is currently working with the Government to provide advice on how to optimise returns on the possible sale of AIB.

Commenting on the selection, Junior Minister, Simon Harris told Newstalk Breakfast that he could not confirm if a fee is being paid to Goldman Sachs - but that he understood that the bank is working on a pro-bono basis.

The Department of Finance has since released a statement saying: “All members of Lot 1 were invited to tender and submit a written presentation covering their credentials, team members for the assignment and various questions relevant to AIB along with a fee proposal."

It continues: "At the end of the process, Goldman scored the highest marks and was therefore appointed following negotiation of their engagement letter.”

It is understood that Goldman Sachs will not receive a fee, but the bank will be eligible to tender for the job of managing a potential IPO or share sale.

There will be a fresh tendering process if the sale goes ahead.

Fianna Fáil's spokesperson on finance, Michael McGrath issued a statement that questioned why the bank would work for free:

"The idea that Goldman Sachs would not charge for its services is entirely implausible. If they are not charging an upfront fee, it is because they perceive an opportunity for much greater payments down the line possibly from underwriting a sale of the State’s shareholding."

He called on the Minister for Finance to clarify the situation.

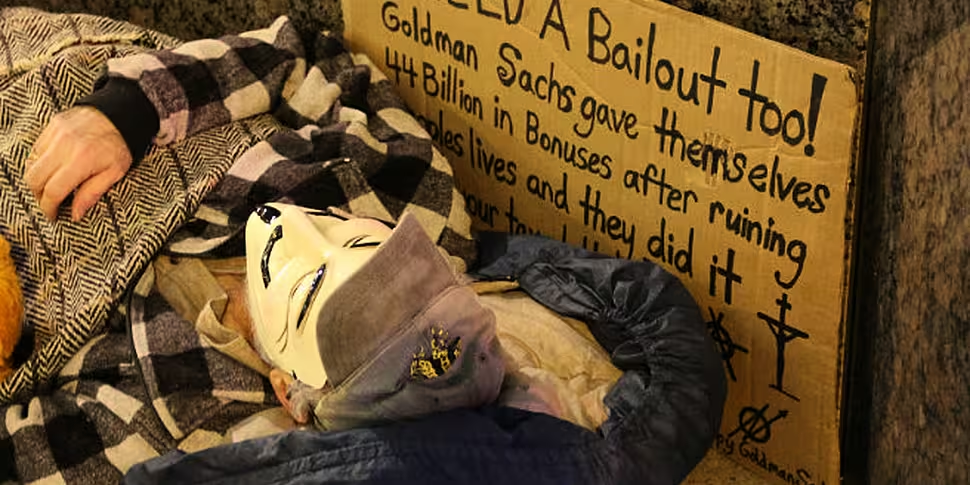

Independent TD Mattie McGrath has expressed his disappointment at the bank's involvement: "The decision by the Minister to appoint Goldman Sachs as the lead adviser on how to maximise the return of state funding in our banks is a disgrace."

The Tipperary South TD highlighted the company's involvement in the initial financial crises: “This is a company that is mired in the manipulation and defrauding of investors in the United States as well as being a company that continually misstated and omitted key facts to the US Securities and Exchanges Commission in 2010.”

The bank was central to the original banking collapse in the United States. Writing in 2010, Rolling Stone journalist and Griftopia author, Matt Taibbi famously described Goldman Sachs as:

"A great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money," continuing, "In fact, the history of the recent financial crisis, which doubles as a history of the rapid decline and fall of the suddenly swindled dry American empire, reads like a Who's Who of Goldman Sachs graduates."