The head of the Central Bank has admitted that new mortgage rules will make it harder for first-time buyers to get a home.

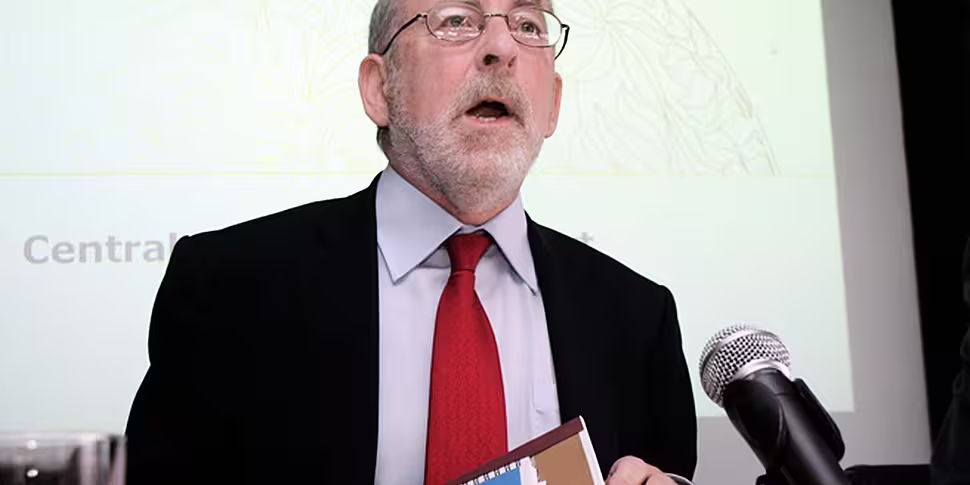

However, Patrick Honohan has said the new rules - limiting loans to first time buyers to 80 per cent - are needed, in order to stop previous mistakes from being repeated.

Many banks say most of their first-time buyers would not have been approved for mortgages under the rules coming in next year.

Mr Honohan, addressing the joint committee on Finance, Public Expenditure and Reform, said the rules are designed simply to stop people taking out loans they'll never be able to afford:

“Excessive reliance on mortgage credit, and this is the experience in the United States, which was imitated by us, the opposite is the effect," he said.

“It can create situations where too many people borrow too much and get into ferocious financial difficulties.

“We know that but we have to think of it in terms of the future as well,” he said.

Mr Honohan also played down the impact of the bank's new rules on mortgage lending, saying banks gave out just 2800 loans to first time buyers of more than 80 per cent in 2013.

“The number of loans more than 80% to first time buyers in 2013 - that’s the year for which I have the data – I think it’s 2800. That’s the number of loans that would have been affected (by the new rules), so it’s not like hundreds of thousands of people are affected by this," he said.

Earlier this month Ulster Bank said nearly two-thirds of its first-time buyers would not qualify for loans under the new proposals.