Shares in Tesco have plunged after the supermarket giant issued another profits warning.

The company said it now expects profits for its financial year, which ends next February, to come in at £1.4 billion (€1.77bn). That’s well below the £1.8-2.2bn that had been forecasted by stock market analysts.

The news sent Tesco shares down as much as 16% at the open in London, wiping as much as £2bn off the company's value. Tesco's shares have lost nearly 48% in the last 12 months.

Tesco didn’t provide any sales data in what is the busiest time of year for retailers. The company's market share in Ireland and Britain has been hit hard by the rise of discount stores like Aldi and Lidl.

The world’s third-biggest supermarket chain has had a year to forget. On top of earlier warnings on trading, in September it revealed an accounting scandal led to it overstating profits to the tune of £263 million. That led to several executives being suspended. It’s also overhauled its top executive team in an attempt to turn around its performance.

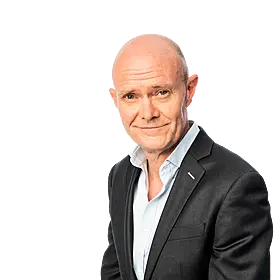

New chief executive Dave Lewis, who is just in the job 100 days, said the changes he’s implementing will take some time.

“Whilst the steps we are taking to achieve this are impacting short-term profitability, they are essential to restoring the health of our business. We will not engage in short term actions that compromise in any way our offer for customers,” Lewis said in a statement today.

Tesco says it will provide an update on the turnaround plan and Christmas trading in early January.