As we approach our first Christmas since the trade deal between the EU and UK came into force, shoppers can expect to pay extra charges when buying from Britain.

It is now nearly two years since the UK officially left the EU; however, negotiations on the new trade deal went down to the wire before it finally came into force on New Year’s Day 2021/

On top of that, the VAT relief on goods worth less than €22 was removed on July 1st – meaning VAT is now payable on everything entering the EU, including from Britain.

While many savvy online shoppers will have got to grips with the changes in recent months, there are others who only shop online ahead of the holidays - and could be in for a shock.

On Lunchtime Live this afternoon, Sinead Ryan, consumer expert and presenter of The Home Show, said people should avoid buying from Britain wherever possible.

“At the moment, with things the way things are, I would avoid at all costs - unless it is literally impossible - just avoid buying stuff from the UK,” she said.

“It is as simple as that because everything is going to be affected. There is no product that is not going to cost you more.

“If Britain triggers Article 16 on the Brexit Agreement between now and Christmas - which now looks increasingly likely - even those bets are off.”

Anyone buying goods for personal use from outside the EU may have to pay:

- Customs Duty

- Excise Duty

- Anti-Dumping Duty

- Countervailing Duty

- Value-Added Tax (VAT)

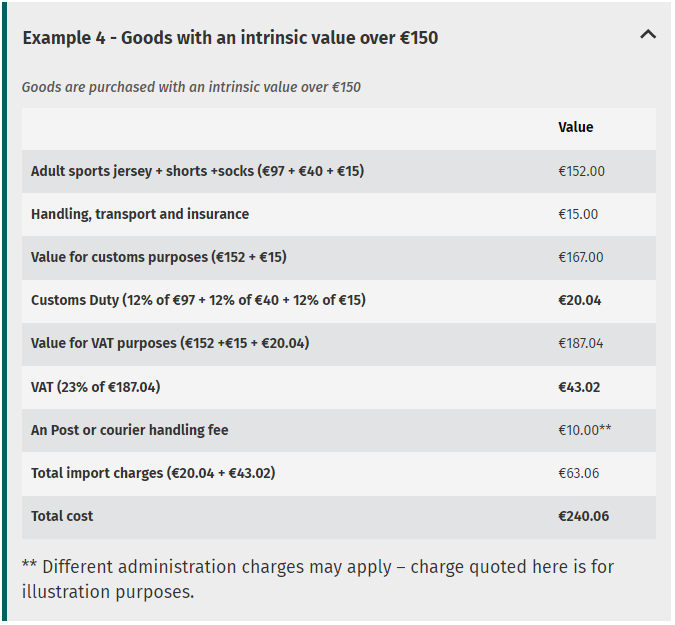

Customs Duty is payable on all packages worth more than €150.

The ‘Customs Value’ of the package includes the cost of the item plus any handling, transport and insurance fees.

Sinead said the main issue facing shoppers is that customs duties can be wildly different depending on what the product is and where it comes from.

“The customs duty is around - we are talking the average - somewhere between 12% and 15% but on some items, it could be 100% and on others it could be 2%,” she said. “The problem is you just don’t know.”

“It is all stored on an immensely complicated website called the Taric.”

Image: Revenue

Image: RevenueValue Added Tax (VAT) is payable on all items entering Ireland from outside the EU.

Sinead said Ireland charges 23% VAT on “practically everything – clothes, shoes, games and toys and all that kind of thing.”

The 23% charged is calculated based on the Customs Value of the package plus the Customs Duty (and any other duty that may be due) and any handling, transport or insurance fees payable in Ireland.

Excise Duty is also payable on alcohol and tobacco products entering the EU.

Finally, some goods will also be subject to Anti-Dumping Duty and Countervailing Duty on entering the bloc.

Sinead said some of the larger online retailers will calculate the extra charge for you – but many do not have the time or resources to do so.

“ASOS or Amazon might do it,” she said. “But they don’t have to and they don’t always.”

You can listen back here: