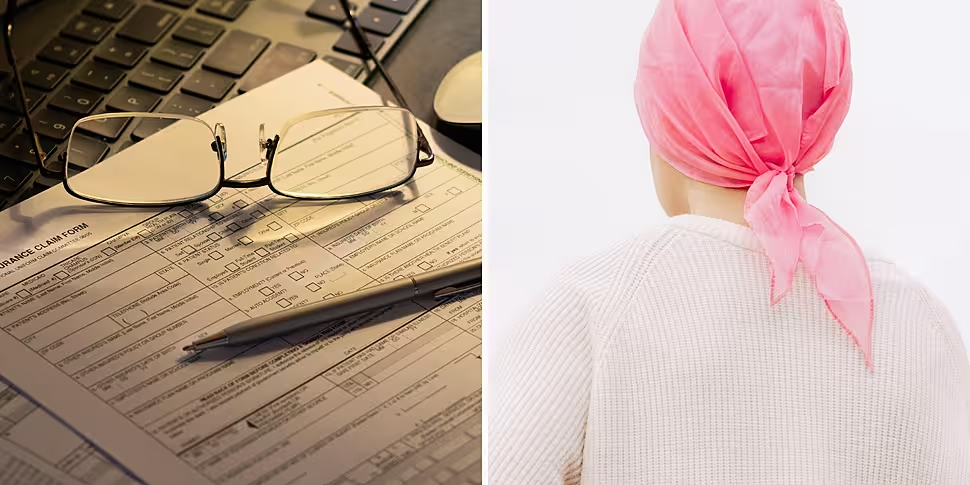

Cancer survivors are struggling to access mortgages and life insurance, years after recovering from the disease.

The Government has been accused of dragging its heels on a new bill which would introduce a ‘Right to be Forgotten’ for cancer survivors – meaning that, after a time, they would no longer have to tell insurance companies about their history.

It comes after the European Parliament called on all member states to ensure that, by 2025, they introduce a Right to be Forgotten a maximum of 10 years after treatment ends.

Meanwhile, people diagnosed as children would have a Right to be Forgotten five years after ending their treatment.

On Breakfast Business with Joe Lynam this morning, Progressive Financial Services spokesman Denis Eustace said insurance companies still “take each case on a case-by-case basis”.

“I can confirm that that’s true because I have had many customers who have come to me who have applied for say a mortgage,” he said.

“The next stage of the journey then is to ensure we can get them mortgage protection of life cover.

“When we apply through the life cover provider … they have to disclose any pre-existing illnesses, such as if they had cancer in the past.

“On a case-by-case basis then, the underwriters for that firm are going to assess whether the risk is going to be too great for them to approve or not.

“My experience is, depending on certain cancers and in particular the staging of the cancers … it really depends on that insurance company’s appetite.”

Right to be Forgotten

Irish Cancer Society research shows that one-quarter of people affected by cancer feel they have been unfairly treated when buying financial products in Ireland.

The Central Bank (Amendment) Bill 2022, which would prohibit financial service providers from discriminating against cancer survivors, remains stuck at second stage in the Seanad; however, the Finance Minister says he remains committed to engaging with senators on the issue.

Reports over the weekend suggested the Irish insurance industry is blocking the legislation and, in a statement, industry body Insurance Ireland said it was working towards the best outcome for cancer survivors while also ensuring other customers are not impacted.

Insurance

It said it is aware of the fact that cancer survivors are being denied insurance but insisted many applications are accepted “at either standard rates or with an additional premium, depending on the condition of the individual”.

“The medical history of a previous cancer diagnosis is very relevant for insurers,” it said.

“Information on a prior cancer diagnosis is necessary to properly understand and quantify the risk in the future.

“Multiple factors such as the type of cancer, stage of cancer, treatment plan, age at diagnosis and duration since cessation of treatment become relevant as the risks differ between these factors.”

Mortgage

It noted that two cancer survivors are not the same and different insurance companies are able to take on different risks.

It said cancer survivors who are denied life insurance can ask lenders for a waiver so they can still get a mortgage.

Mr Eustace said cancer is not the only illness that sends up red flags for insurance providers.

He said it also remains very difficult to get approved for life insurance if you have a history of clinical depression.

You can listen back here: