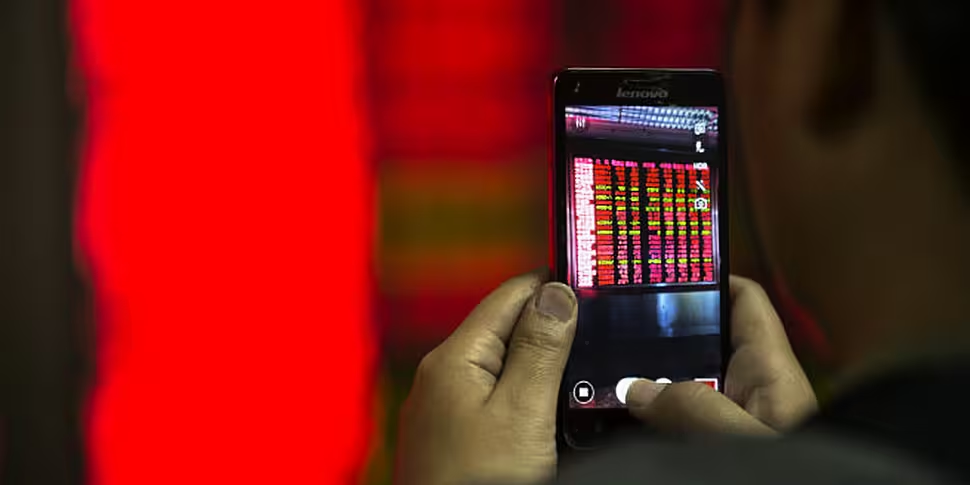

China’s stock markets look as if they will close 1% - 2% higher today after China's authorities moved to ease some of the panic selling witnessed earlier in the week by removing the so-called circuit breakers that forced suspension of trading when share prices fell by more than 7%.

The Central Bank of China also set a stable trading range for its currency the Yuan last night, following eight successive days in which it allowed its value devalue against the dollar and other currencies by a cumulative 3%.

Concerns about why the Chinese authorities continue to devalue the Yuan, whether it signals that the economy is slowing much more sharply than official data indicates, and its competitive impact on other emerging exporting economies, underlie some of the sharp volatility we’ve seen on global markets this week.

Another major factor is the continuing slippage in the price of oil and other commodities, upon which so many economies rely for export revenues. The price of Brent Crude slipped below $33 per barrel yesterday – lowest for 12 years.

Close to €2.4bn was wiped off of the value of shares listed on the ISEQ in Dublin on Thursday - while over €40bn was lost on London's FTSE 100.