Cuts to the Universal Social Charge (USC) will put money back into people's pockets, Fianna Fáil Senator Malcolm Byrne has said.

Finance Minister Michael McGrath is considering the move as part of a new tax package which could be worth a more than €1 billion.

He has refused to confirm what that will look like but said USC could be in line for a reduction as part of a wider review of the tax code.

Senator Byrne told The Hard Shoulder changes would be the responsible thing to do.

"We are keen to look at trying to cut the Universal Social Charge, particularly to benefit lower and middle-income wage earners," he said.

"It's also about being responsible, because what we are looking at this year is potentially a surplus of something in the order of €10bn to €12bn.

"That's not what the Government is going to be talking about spending.

"The overall package is going to be something of the order of about €6bn, up to €5bn of that is going to be on services.

"So, the tax package will only represent €1.1bn.

"By making changes to the USC... it will put money back into the pockets, but particularly of those who are low and middle-income earners."

'It is a bad idea'

Dr Aidan Regan, Associate Professor in the School of Politics and International Relations at UCD, said such a change would narrow the tax base even further.

"I think anything that narrows the income tax base further than what is an already highly concentrated narrow tax base is a bad idea," he said.

"80% of Ireland's income tax base is payed by 20% of wage earners.

"People would be aware that the corporate tax base is extremely narrow; most of the corporate taxes are paid by a handful of global multinationals.

"We have a corporate tax boom at the moment which is an invitation for the Government to do lots of physically silly things, let's say.

"So, I think in this period of time [and] into the future, cutting the tax base further... is just going to basically undermine the fiscal capacity of the State to do the things that we need to do."

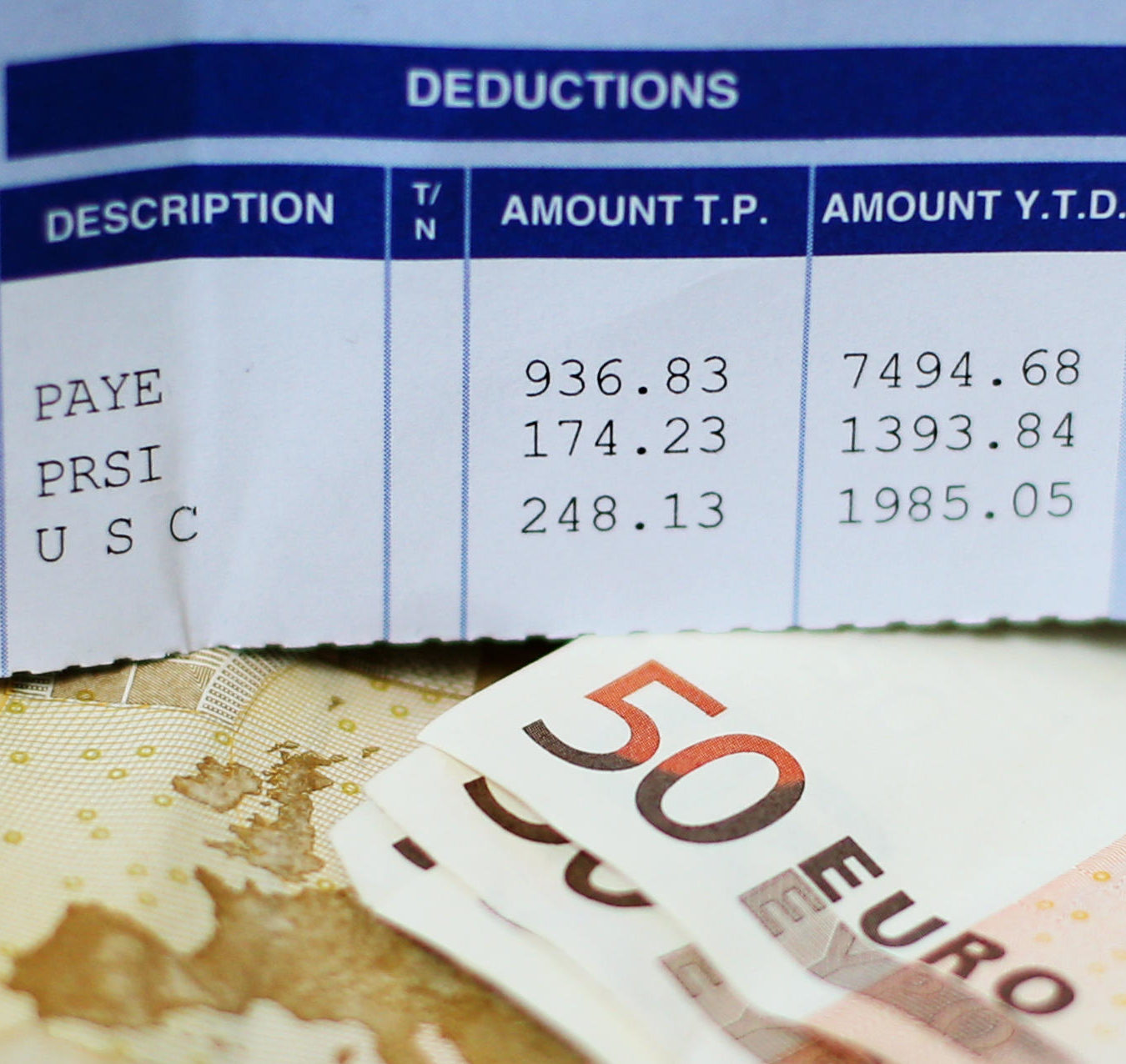

A payslip displaying tax deductions alongside €50 notes in 2014. Image: PA Images/Alamy Stock Photo/Brian Lawless

A payslip displaying tax deductions alongside €50 notes in 2014. Image: PA Images/Alamy Stock Photo/Brian LawlessDr Regan said cuts now could need to be clawed back in a few years.

"You can cut a few quid off and you can save a couple of billion, but at the end of the day trying to get that back is very difficult," he said.

"If you begin to cut and you say in two or three years time, 'That corporate tax boom is coming to an end'... so we either borrow it or we raise it through revenue and taxes.

"This is just the reality of future thinking," he added.

Listen back here: