Investment and texting scams have reached "epidemic proportions" this year, according to the Banking and Payments Federation.

In 2022, over €10 million was lost to scamming schemes.

As of May this year, that number has already been surpassed.

Speaking to The Pat Kenny Show, the Banking and Payments Federation Ireland's Head of Financial Crime, Niamh Davenport, gave some tips on how to avoid falling victim to online scams.

"We're having smishing – which is the text message scams – and then we have other types of fraud which are the investment scams and we've seen a lot of those since the start of this year," she said.

Investment scams

Ms Davenport said investment scams typically occur as a result of individuals trying to invest in bonds or cryptocurrency.

"They come across a website that promises good returns or good yields," she said.

"They'll put their details in and look for a callback and somebody will call them back – because you're getting a callback, you think it's a genuine investment scheme, and often go and invest.

"The minimum investment we've seen is €20,000 which is a lot of money.

"The age group they're targeting are people coming up to retirement age that may be looking at their pension funds."

Elder Senior Scam Call (Panther Media GmbH / Alamy Stock Photo)

Elder Senior Scam Call (Panther Media GmbH / Alamy Stock Photo)Ms Davenport recommends those interested in investing their money in a firm go through the firm directly.

"Pick up the phone or go to the offices if you can or go to a broker in your local area that you can go face-to-face with," she said.

Text scams

With text message scams, Ms Davenport warns that users need to be "so alert" to not find themselves in trouble.

"About 90% of text scams are actually not from your banks, they're impersonating somebody else," she said.

"Whether it's the HSE, whether it's E-flow, [or] packaged delivery services – if there is a link to be clicked on, my advice is do not click on the link.

"If you are expecting a package, go to the website directly and log in that way and you can check it, but never click on links from text messages.

"The same in emails – I would never click on a link."

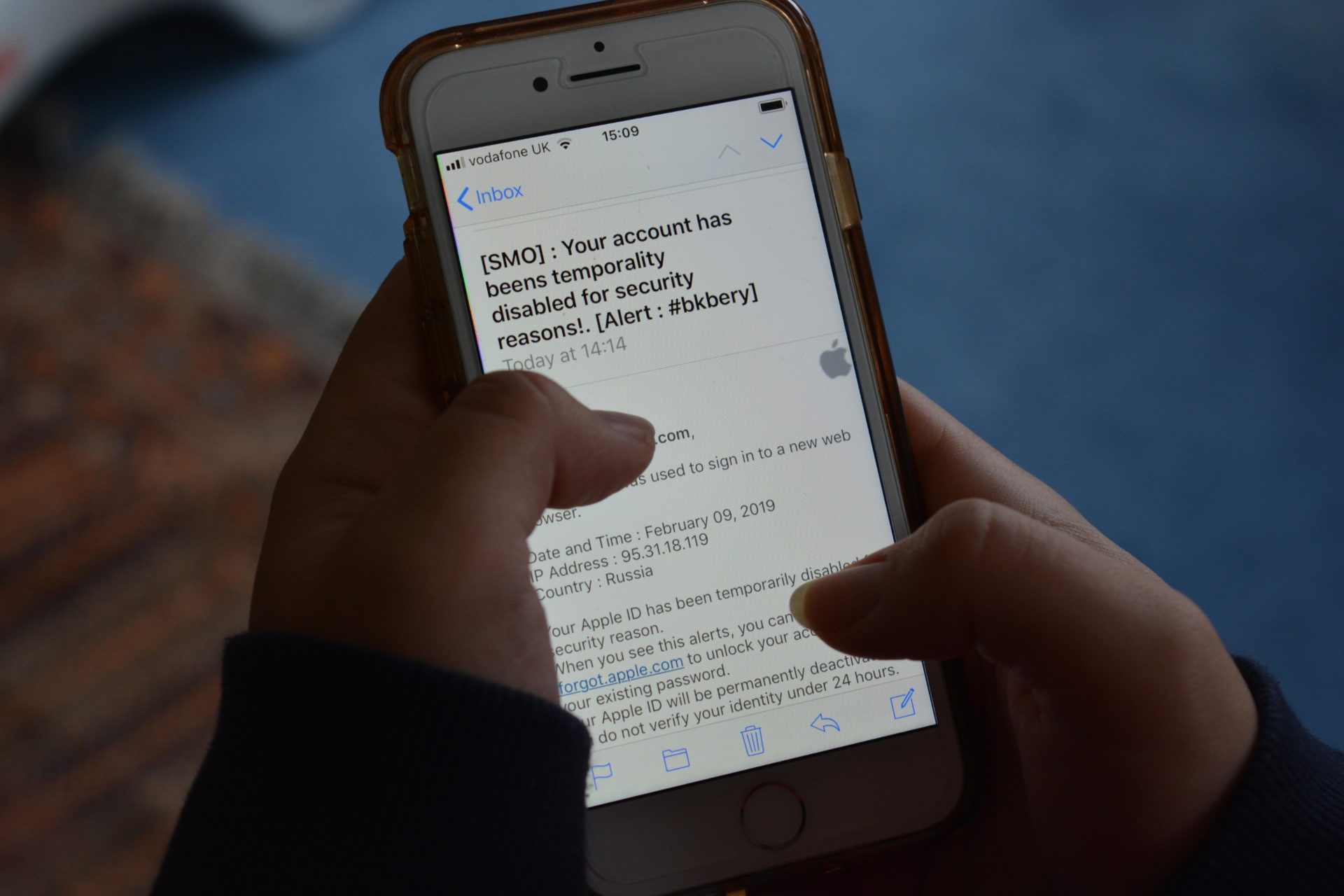

Phishing / scam email, purporting to be from Apple claiming that the account has been disabled and asking user to log in to reset password (Josie Elias / Alamy Stock Photo)

Phishing / scam email, purporting to be from Apple claiming that the account has been disabled and asking user to log in to reset password (Josie Elias / Alamy Stock Photo)'How do I fix this?'

If you do find yourself a victim of an investment scam, Ms Davenport said "time is of the essence."

"The sooner you report it, the better chance you have of getting that money back," she said.

"You need to contact your bank immediately as soon as you realise or even think you may be a victim of one of these scams.

"We have had incidents where some of our members have contacted people making payments saying, 'We really don't think you should make this payment' – really heed that call."

You can listen here: