Fine Gael is said to be looking at the prospect of further tax cuts in coming years in a bid to win back voters who are increasingly turning towards Sinn Féin.

The Irish Independent reports the point at which workers begin to pay the top rate of income tax could be increased to €40,000 over the next three years.

It comes after the entry point to the top rate was increased by €1,500 to €36,800 in the recent budget - a change which will come into effect from next month.

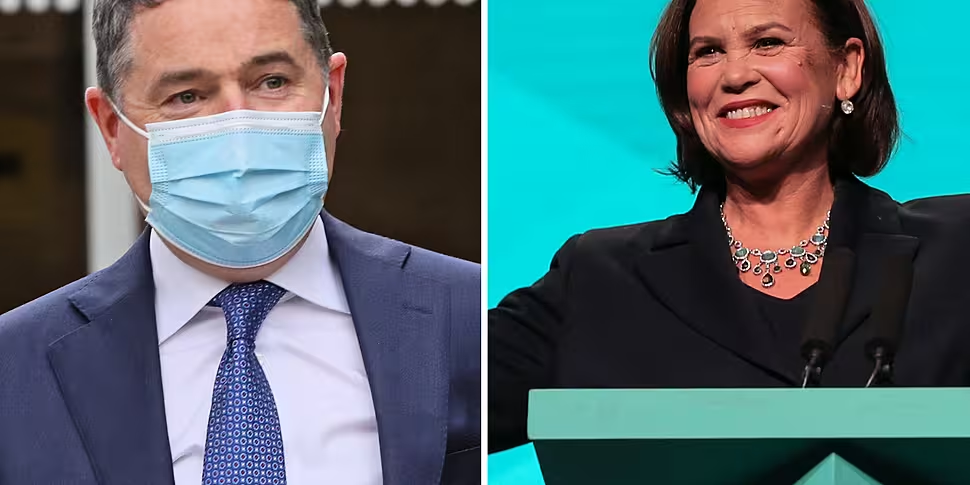

Finance Minister Paschal Donohoe says we’re likely to see a repeat of that kind of move in future budgets.

Raising the band to €40,000 would save workers earning €45,000 around €600 a year.

The comments come against a continued rise in support for Sinn Féin.

An Ipsos MRBI survey for The Irish Times yesterday showed Sinn Féin up three points to 35% support - well ahead of both Fianna Fáil and Fine Gael, who are both on 20%.

That paper reports that Sinn Féin is now also the "leading party of middle class Ireland".

If the recent poll results carry into the next election - currently due to take place in 2025 if the current coalition completes a full term - it would put Sinn Féin in a commanding position to lead the next government.

Tax cuts

Philip Ryan, the political editor of The Irish Independent, told The Anton Savage Show tax cuts are definitely something Fine Gael has been planning.

He said: “The Finance Minister has given us a bit more detail on what these tax cuts might look like.

“We’ve seen this process gradually happen over the last three-four budgets. Instead of slashing USC or reducing income tax rates, what they have been doing is increasing the bands - the point at which you start paying the top rate of tax on your income.

“Fine Gael clearly sees this as a good feeding ground for votes... in a part of society that feels sometimes they contribute everything through their taxes, but don't get a whole lot back."

He said voters shouldn’t expect a sudden, big change to their income - instead, there’ll be small changes that will happen gradually over several years.

He said: “You’re never going to hear the Budget announced and suddenly be ten-fifteen grand richer - well, it depends on circumstances in some way.

“But think about how long we went without tax cuts. Even when you’re changing a band… that’s going to cost [the Government] a few hundred million euro. Small changes cost big money.”

Philip said Fine Gael is constrained by the terms of the programme for government.

Around €500 million has been factored in for future tax cuts - although Philip stressed that won’t all won’t go towards reducing people’s income tax bills.

Tax cuts will also happen against the backdrop of record-high inflation and the resulting impact on households’ funds.

Sinn Féin support

Mairead Farrell, Sinn Féin spokesperson on Public Expenditure and Reform, told Anton it's clear there's now a "huge change" in the support her party has been receiving.

She said the last election showed many people wanted something different - and now, nearly two years on, that trend has only continued.

Deputy Farrell believes people have a "real affinity" with Sinn Féin leader Mary Lou McDonald, but there's also a lot of support for prominent members such as Pearse Doherty, Louise O'Reilly and Eoin Ó Broin.

She said: "I think what people see is a coordinated, solid team that knows what they're doing and is ready for government."