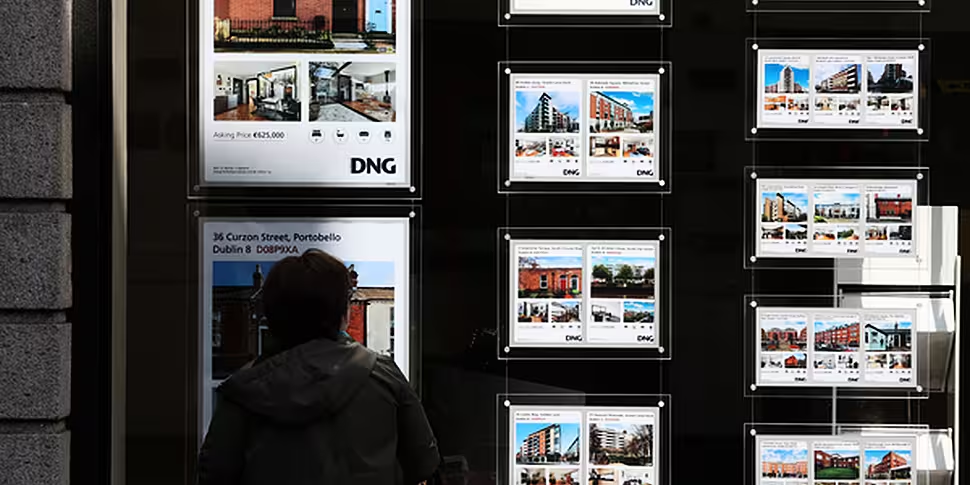

House prices have risen by 3.1% in the third quarter of this year, according to a new report.

The Daft.ie House Price Report says the typical listed price nationwide was €344,848.

That is 6.2% higher than in the same period a year earlier and 37% higher than at the onset of the COVID-19 pandemic.

The percentage increase was greatest in Dublin, where prices rose by 4.1% between June and September.

This is the largest three-month increase in the capital since early 2017 and means that prices there are on average more than 6% higher than year ago.

Average list price and year-on-year change – major cities, Q3 2024

- Dublin City: €463,265, up 6.2%

- Cork City: €354,307, up 3.8%

- Limerick City: €292,437, up 9.7%

- Galway City: €388,604, up 4.1%

- Waterford City: €249,792, up 3.4%

- Rest of the country: €294,541, up 6.3%

This means that annual inflation in Dublin is higher than the average of the other four cities for the first time since 2020.

In Cork, Galway and Waterford cities, prices in the third quarter were roughly 4% higher than a year ago.

Inflation in Limerick city remains higher, however, at 9.7%, while the average increase outside the cities in the year was 6.3%.

Second-hand homes

The number of second-hand homes available to buy nationwide on September 1st stood at less than 11,900 - down 12% year-on-year - the 15th month of contracting supply.

Daft says the fall in availability "largely reflects a dip in the number of second-hand homes coming on to the market over the last year", with just over 51,000 homes on the market in the 12 months to September, compared to almost 57,000 a year ago.

Report author and Trinity College Economist Ronan Lyons said it all comes back to a lack of houses on the market.

"While the volume of new homes being built and bought has largely held up in recent quarters, despite rising interest rates, the same cannot be said of the second-hand market," he said.

"The number of homes coming on to the second-hand market remains very weak.

"The resulting scarcity of homes has pushed prices up, especially in Dublin, where new homes are being built.

"The typical second-hand home bought in Dublin between June and September sold for 7.6% above its listed price, the biggest gap since records began in 2010."

Mr Lyons said conditions elsewhere are similar, with a record average premium of 5.4% above the listed price nationally.

"The slow decline in mortgage interest rates will help the market, as will sitting homeowners coming off fixed-rate mortgages," he said

"But these factors are largely outside of policymaker control."

He added that the underlying issue remains a lack of homes "of all kinds" and that this should remain the focus for policymakers "before and after the next election".