Latest figures are pointing to a slowdown in mortgage activity as switching levels drop by over 50%.

That is according to new data from the Banking & Payments Federation Ireland.

It said first-time buyers now account for 62% of approval volumes - the highest share since data became available in July 2014.

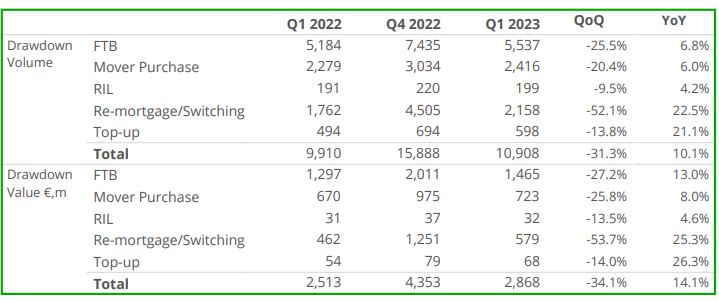

A total of 10,908 new mortgages were drawndown by borrowers during the first quarter this year.

Source: BPFI

Source: BPFIThis represents an increase of 10.1% in volume and 14.1% in value in the same period for 2022.

However, when compared to the first quarter of 2023, this is a drop of 31.3% in volume and 34.1% in value.

BPFI has said while re-mortgage or switching volumes and values rose by 22.5% and 25.3% year-on-year respectively, they actually fell by 52.1% and 53.7% on the previous quarter.

'Year-on-year slowdown'

Brian Hayes, Chief Executive of the BPFI, said demands remains strong.

"Our latest mortgage figures show that in terms of mortgage drawdowns, demand remains strong with 10,908 new mortgages to the value of €2.9 billion drawndown by borrowers during the first quarter of 2023," he said.

"However overall, the figures point to a continued year-on-year slowdown as the impetus from switching decreases.

"Mortgage approval volumes in March fell by 1.2% year-on-year while switching volumes dropped by 54.4%".

Mr Hayes said that trends in the home buyer segments are looking positive.

"First-time buyer (FTB) and mover purchase drawdown volumes reached their highest first quarter levels since 2007 and 2008 respectively," he said.

"Looking forward, FTB approval volumes rose by 15.7% year on year with FTBs accounting for 62% of approval volumes, the highest share since data became available in July 2014," he added.