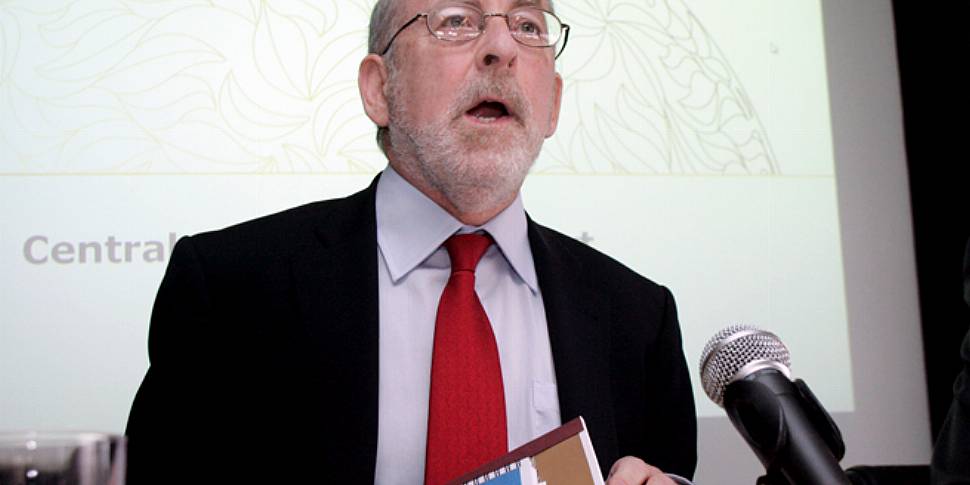

Central Bank governor Patrick Honohan has been discussing Ireland's new mortgage regulations and explaining the decision to impose less strict lending rules on first time buyers:

“First-time buyers of the smaller houses never caused a boom - and it is stopping a boom and preventing a credit chasing prices bubble that we’re trying to ensure against,” he said.

The new regulations will mean that new buyers will be able to borrow 90 per cent of the value of a property up to €220,000 - the remaining amount will require a 20 percent deposit.

Mr Honohan has indicated that the cut-off point was picked because half of the houses currently being sold to first-time buyers in Dublin are below this price.

Speaking to The Pat Kenny Show today, Taoiseach, Enda Kenny said he thinks that the new regulations are fair and that they "strike the right balance."

He added: "I never again want to see a situation where young couples are walking into the trap of negative equity."

Sinn Féin has cautiously welcomed the new rules - finance spokesperson Pearse Doherty said: "I give a broad welcome to the Central Bank’s new rules. Sinn Féin fully supports the principle behind the move. Regulation such as these new rules have a crucial role to play in creating a normal healthy lending market that is not based on runaway property prices fuelled by credit."

Fianna Fáil's finance spokesperson, Michael McGrath has said that he has reservations for what the rules will mean for buyers not taking their first step onto the property ladder: "I am very concerned with the rules that are being proposed in relation to non-first time buyers."

He continues: "This could result in an entire generation of people being trapped in houses and apartments which are no longer suitable for their needs, even though they have demonstrated a clear capacity to meet their existing mortgage payments."

Here are five properties that are currently on the market for €220,000 or less.