Hundreds of thousands of people have yet to contact Revenue about the tax they owe on their Pandemic Unemployment Payments (PUP).

Close to 300,000 taxpayers who received the PUP and the Temporary Wage Subsidy Scheme (TWSS) payments have not filed a tax return.

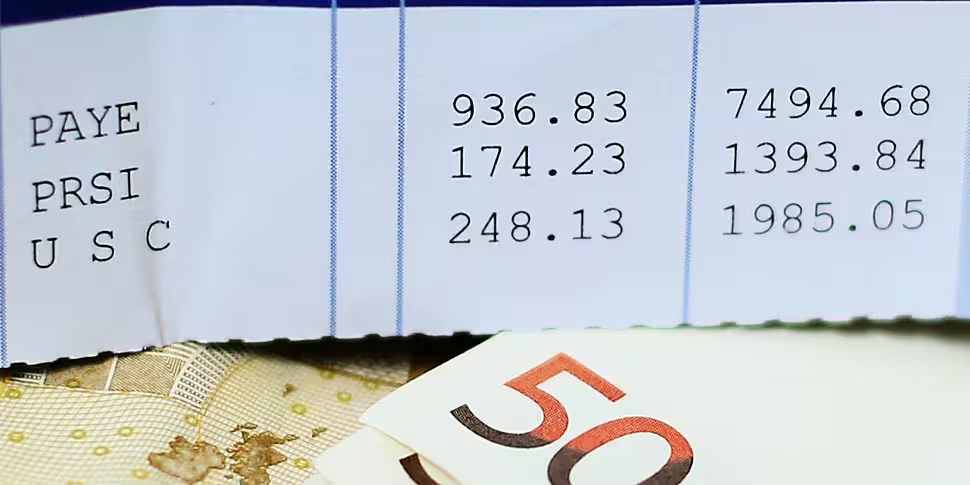

Some of those who got the PUP could face hefty tax bills of up to €2,500. These people owe €219 million in taxes combined.

Taxback.com Consumer Tax Manager Marian Ryan told Newstalk Breakfast there are ways to reduce the bill.

"I suppose it's kind of like the hangover from COVID," she said.

"The main thing to bear in mind is that it can be paid off over the four years.

"Things like your tax credits, your flat-rate expenses, even the Working from Home relief - all of that is really going to help people out there.

"It's not something that can be avoided."

Wage Subsidy Scheme

She said those whose employers claimed the TWSS could be hardest hit.

"The people that are really getting impacted by this... there's people that worked the whole way through the pandemic, their employer was getting the Wage Subsidy; they never had a day off, they had to put on their masks and face into it and they're the ones that are facing the €1,300/€2,500 tax bill at the end of it," she said.

She said people can work out their PUP tax bill in a number of ways.

"We can do a review for people," she said "What I would say as well is that you can review four years at a time.

"2020 is the year that there's going to potentially be the underpayment for people, but we also have 18, 19 and 2021 open now for review.

"They might have refunds for those years which they can offset against it.

"It's really important to remember as well that the Revenue have said that you're not going to get a bill tomorrow [saying] pay us €2,500.

"They'll reduce your tax credits over the following four years, and they'll offset any refunds you have as well.

"The Revenue haven't said that you need to file this return immediately; with the PAYE workers you have four years to file your return once the tax year is finished," she added.