Donald Trump has claimed the US is "locked and loaded" to respond to attacks on oil supplies in Saudi Arabia.

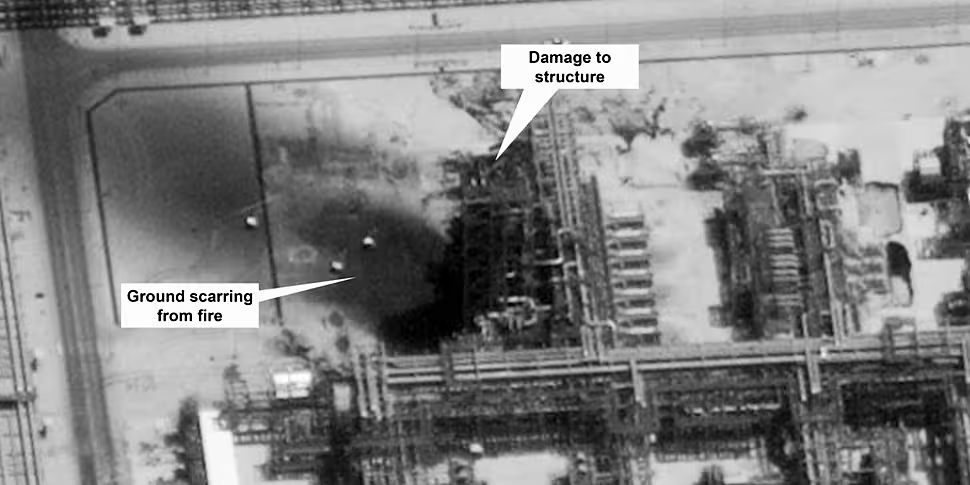

Two attacks on the facilities on Saturday knocked out more than 5% of global supply.

Oil prices surged by at least 15% following the attack.

Yemen's Houthi rebels have claimed responsibility for the drone strikes.

Over the weekend, however, the US Secretary of State Mike Pompeo directly accused Iran of being behind the "unprecedented attack".

Tehran is behind nearly 100 attacks on Saudi Arabia while Rouhani and Zarif pretend to engage in diplomacy. Amid all the calls for de-escalation, Iran has now launched an unprecedented attack on the world’s energy supply. There is no evidence the attacks came from Yemen.

— Secretary Pompeo (@SecPompeo) September 14, 2019

Iran has "categorically" denied any involvement in the strikes.

Foreign ministry spokesman Seyed Abbas Mousavi today suggested any accusations were "baseless and untrue", the Fars news agency reports.

It follows an earlier denial from Iran's foreign minister:

Having failed at "max pressure", @SecPompeo's turning to "max deceit"

US & its clients are stuck in Yemen because of illusion that weapon superiority will lead to military victory.

Blaming Iran won't end disaster. Accepting our April '15 proposal to end war & begin talks may.— Javad Zarif (@JZarif) September 15, 2019

In a tweet on Sunday evening, President Trump did not mention Iran.

He instead suggested: "There is reason to believe that we know the culprit, are locked and loaded depending on verification, but are waiting to hear from the Kingdom as to who they believe was the cause of this attack, and under what terms we would proceed!"

Separately, he said he has authorised the release of oil from the US emergency Strategic Petroleum Reserve "if needed", amid concerns over potential price rises due to the disruption to supply.

Analysts have warned motorists are likely to feel the effects in coming days as pump prices are set to rise.

In the US, Californian motorists to be hit the hardest as the state relies on Saudi oil imports more than any other.

Brent crude futures soared by 19.5% as trading opened in New York on Sunday evening, with a session high of $71.95 (€64.97) a barrel - the highest level since May and the biggest jump in 28 years.

It later settled to a 13% jump at $68.06 (€61.46) per barrel.