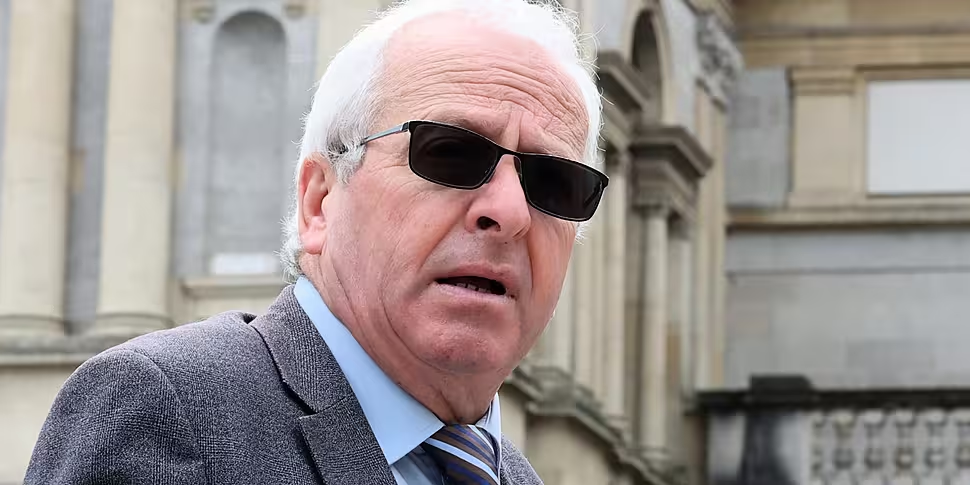

The Government is trying to get rid of cash 'by stealth' despite making promises about keeping it in the economy, a Tipperary TD has claimed.

Independent TD Mattie McGrath is backing a new Oireachtas Finance Committee report, which has found that ATMs should dispense notes smaller than €50.

He said many people on lower incomes, including pensioners, may not have a lot of money in their account and "may need smaller notes than €50".

Under new Access to Cash laws supermarkets and pharmacies will have to accept cash, with medicine and groceries deemed ‘essential services’.

Deputy McGrath told Newstalk Breakfast he handed back a cup of tea during a recent train journey as Irish Rail would not take cash for the drink.

"I was on the train last week from Thurles to Dublin [and I] couldn't buy a cup of tea with cash," he said.

"I did [give the tea back] and I was sorry for the lady who was doing the business.

"Obviously Iarnród Éireann has privatised out that work [of] the cafeteria on the train and they don't take cash.

"Then again, on the train on Heuston Station to Dublin and they do take cash so it's all over the place".

A food trolley cart is seen on the Enterprise train between Belfast and Dublin in March 2019. Image: Radharc Images / Alamy

A food trolley cart is seen on the Enterprise train between Belfast and Dublin in March 2019. Image: Radharc Images / AlamyIn a statement, Irish Rail said the fact services would be cashless was “well detailed” when it reintroduced catering on some trains last summer.

It said it is now in the process of rolling out a full catering service.

"Our catering provider operates on a cashless basis - this was in the context of both cost and security, as we restored catering services on [the Cork-Dublin route] on an interim basis,” it said.

"We are currently out to tender for a national catering tender which seeks quotes on the basis of cash being accepted also."

'Playing mind games'

Under the new laws there will also have to be a certain number of ATMs per 100,000 people and within 10km of where they live.

Deputy McGrath has branded the plans to ensure people have more access to ATMs as "nothing short of a PR stunt".

"They're being removed and I have three towns in Cahir, Cashel and Templemore where Bank of Ireland just withdrew their ATM machines," he said.

"Then there was a threat to an AIB one but that remained thankfully.

"Many towns now - whether it's a private operator or a Credit Union if they are lucky to have them - they really are trying by stealth to get rid of cash".

Deputy McGrath said it was "like playing hurling without a ball".

"They say they're not [removing ATMs] and they make all these nice soundings," he said.

"They're not listening to the people, they're playing games with the people, mind games," he added.

He said promises over smaller note denominations are pointless unless there are ATMs to access the cash.

Currently, businesses must accept cash unless it is clear they only accept other ways to pay.

The Competition and Consumer Protection Commission (CCPC) has said this can be as simple as a sign in the shop saying 'card transactions only'.

The use of physical cash has fallen from €20 billion before the pandemic to €13.5 billion in 2022.