US companies will still look to Ireland even if there are sweeping changes to international corporate tax rates, a senior US congressman has insisted.

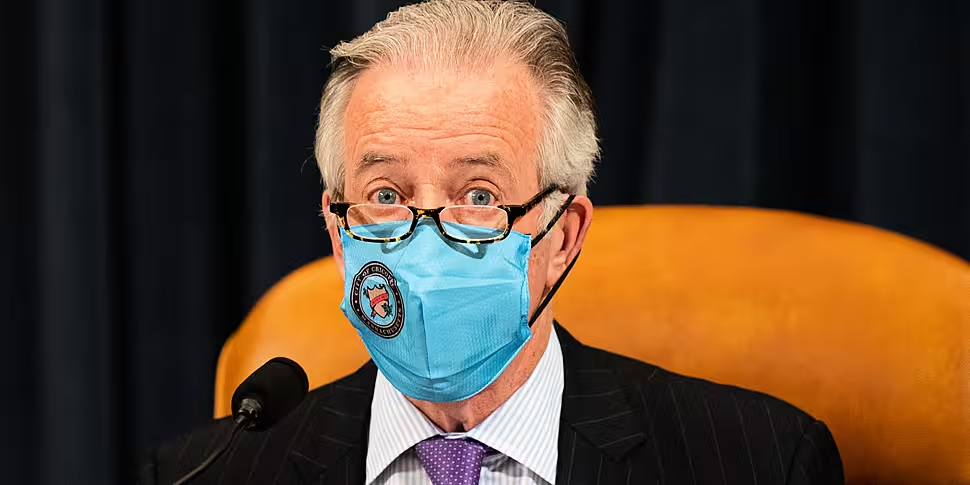

Richard Neal says he believes "we'll all be better off" if there's a more harmonised international system.

The Biden administration is pushing for a global minimum corporate tax rate of at least 15%.

OECD discussions on the proposals are ongoing, but any change is likely to have a major impact on countries with lower corporate tax rates - including Ireland.

The Irish Government has defended its 12.5% rate, saying small countries need flexibility so they can compete globally.

However, Ireland has frequently drawn international criticism for its tax policies, especially as many major US multinationals run operations here while paying little to no corporation tax.

Congressman Neal - who today addressed an online event organised by the Institute of International and European Affairs (IIEA) - told The Hard Shoulder he does believe tax systems are a "sovereign decision" for individual countries.

He said: “Do I think Ireland is a tax avoidance haven? No, I don’t.

"Do I think they’ve adopted a corporate rate that they believe is competitive in terms of international jurisdiction? I do, but that’s up to them.”

Nonetheless, he believes there's a “legitimate purpose” in the US goal of taxation reform, suggesting “we would all be better off” with a more harmonised international tax system.

He said US officials believe a harmonised system will be vital if there's to be any major EU-US trade deal, and that the Biden administration wants changes so they can fund their own major infrastructure projects.

However, he believes Ireland will still draw international investment even if the changes proceed as planned.

Congressman Neal - who chairs the House of Representatives Ways and Means Committee - told Kieran: “It’s my belief that Ireland’s commitment over succeeding generations to education and making sure their population is competitive in the international sphere… is at least as responsible for the success that Ireland has had economically as their corporate tax rate.

“American companies are always going to be looking for opportunities with a well-versed population. Ireland has it.”

He stressed that the US is "not attempting to be punitive", and simply wants a fair and competitive international tax system.