After just over a week in government, Greece's Syriza party hit its first major speed bump last night as the European Central Bank (ECB) announced that it will no longer accept Greek government bonds as collateral for lending money to commercial banks.

The markets didn't react well to the news - the exchange-traded fund that tracks Greek stocks, GREK, fell by over 10 percent.

Greek newspaper Kathimerini reports that the interest rate will be 1.55 percent, compared to the 0.05 percent that was paid for the ECB financing.

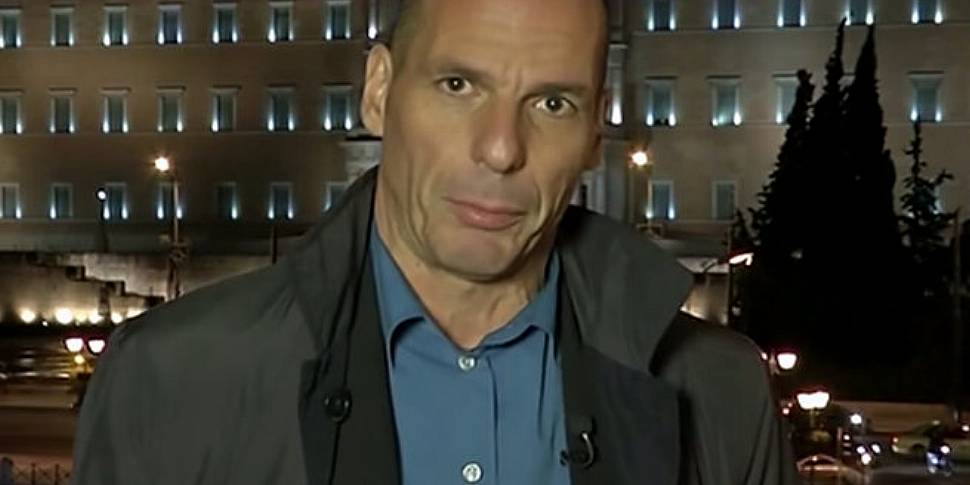

This ups the stakes for Greek Finance Minister, Yanis Varoufakis' meeting with his German counterpart, Wolfgang Schaeuble today.

Since Syriza was elected on an anti-austerity platform, Mr Schaeuble has insisted that this changes "nothing" in Greece's relationship with both Germany and the EU.

He has also said that there is "no alternative" to the current austere financial programme in Greece.

Mr Varoufakis has been critical of media coverage that has framed the discussions as a "wild west style" showdown - but it is hard to look at today's meeting in any other terms as both officials believe so strongly in opposing approaches to fixing the euro zone's problems.

Cash flow

It is widely believed that Greece only has the cash to run the country for between three and four weeks. Bloomberg reports that sources in the Greek parliament have confirmed this timeline.

If the country cannot raise the €15bn limit on short-term borrowing set by the Troika - it could run out of money by February 25th according to Bloomberg's anonymous Greek source.

Syriza ministers have been touring Europe attempting to find allies to support a plan that would swap the country's EU and IMF loans for new bonds - the repayment of these bonds would be linked to the performance of the Greek economy.

Irish Times' European correspondent Suzanne Lynch discussed the ramifications of the ECB announcement for both Greece and Ireland with Newstalk Breakfast.

Cautious Optimism...

Greek prime minister Alexis Tsipras had said that he was "optimistic" that the country will reach an agreement with the EU after meetings with Jean Claude Juncker and European Parliament President, Martin Schulz.

Mr Schulz was also positive about the meeting, saying: "Mr Tsipras is battling for European cooperation, not only seeking a solution for Greece. He has my full support."

Mr Varoufakis also described his talks with ECB President Mario Draghi as "fruitful" hours before the ECB announcement.

Who's owed what?

The bulk of Greece's debt is owed to euro zone members - after last night it looks like there will need to be a major development in the relationship between Greece and Europe in the next three weeks.

Yanis Varoufakis' talks in Paris, Rome and London showed signs that Greece could find governments who would be willing to help them to push through reforms to restructure the country's debts.

Last night's announcement was the party's first real setback - and a reminder that the new Greek government is facing a difficult few weeks.