A consumer journalist says people need to make themselves aware about VAT and customs charges on non-EU goods coming into Ireland.

Siobhan Maguire says Britain is also in that category since Brexit.

She told Lunchtime Live this is something people need to pay attention to.

"The UK now falls into the same categories as if we were buying from China and America.

"And unfortunately fees do apply - so beyond the shipping and handling you're looking at VAT fees, and then you are looking at this administration fee."

Sinead says this needs to be kept on the radar.

"When we stop talking about things like customs charges, we tend to think that everything's suddenly rosey in the garden again and we don't need to be worried about them.

"But absolutely you need to be worried about them."

'This catches people out'

But she says even buying from a '.ie' website isn't clear cut.

"This catches people out all the time: I could be in Bangladesh or Hong Kong and have a '.ie' domain name and sell to you whatever you want to buy from me.

"And you will still have to pay all those additional changes and VAT and admin charges."

Online shopping with credit card | Picture by: FrankHoermann/SVEN SIMON/DPA/PA Images

Online shopping with credit card | Picture by: FrankHoermann/SVEN SIMON/DPA/PA ImagesBut she says there is a way to see exactly where a seller or service is based.

"A lot of times consumers don't do this because we're time poor, and we think we just need to buy on the button.

"But you need to go into 'terms and conditions' and see exactly where that company is located.

"For example, I was going to buy something - it looked exactly like it was based in Ireland, the company.

"When I looked at the terms and conditions, they were based in Milton Keynes.

"That was the only way I would have known that company was not in Ireland.

"You might have to scroll down through quite a bit of legal derg, but you will find 'Trading as' and that's the address".

'There's no escaping that'

Siobhan says when you buy, you're entering into a contract with the seller to pay any extra charges.

"When you're buying something into the country... you're entering into a contract, basically, with the retailer that you're purchasing from that you're aware there may be additional fees applied.

"Those fees will be to Revenue - now there's no escaping that.

"When you buy from the UK and there's VAT added, that VAT would be applied to VAT that is brought into place in Ireland.

"You're not paying UK VAT, you're paying the Irish VAT that applies to that particular product.

"Traders aren't under any onus to make it clear at the point of purchase what the additional fees will be.

"They have to tell you there may be additional fees - but the likes of retailers like Amazon, at the point of purchase, will tell you exactly what the entire cost is going to be".

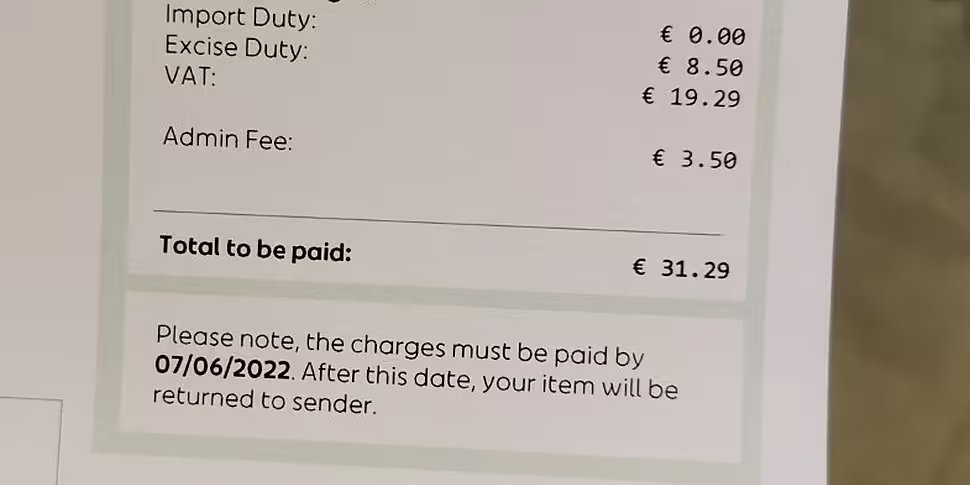

And she says a customs charge in relation to this is standard.

"This customs admin fee of €3.50 is charged by An Post for customs/handling of items from countries outside of the EU.

"This is a standard fee, it has been in place - it shouldn't surprise consumers anymore, we should make ourselves aware of all these charges.

"And it's in addition to any duty or VAT payable to Irish Revenue.

"That €3.50 basically covers the likes of administrative costs of collecting and processing the payment from the addressee".

An Post response

In a statement, An Post says: "We are required by Revenue to collect outstanding VAT and other charges.

"Our administration fee covers the collection and administration of those charges.

"In any event its very much a matter for Revenue."

While in its statement, Revenue says: "Revenue has no role to play in the regulation of administration fees charged by parcel operators who deliver goods to an importer.

"That is a commercial arrangement between the parcel operator concerned and the importer.

"These businesses do not act on behalf of, nor do they collect the relevant taxes and duties on behalf of Revenue - but rather they act on the behalf of the importer and assist the importer in the correct clearance of their goods imported from outside the European Union."

Revenue adds that it is "normal practice" for parcel operators to charge an administration fee.